When Someone Else is YOU: Protect yourself against identity theft

Identity theft. It’s something you always hear about, but chances are you might not know just how at risk you (and your children) are. Rose Barker joins us today to tell us what to be on the lookout for, and shares with us a way to protect yourself.

——

4word: What does identity theft look like in 2016?

Rose: In 2015, reported cases jumped to 16.6 million, from 12.6 million the previous year. The problem continues to grow in 2016.

Identity theft is one of the only crimes where you’re guilty until proven innocent. I hear stories of victims who are pulled over for a broken tail light, but they end up in jail because there’s a warrant out for their arrest due to identity theft.

Identity theft is one of the only crimes where you’re guilty until proven innocent. I hear stories of victims who are pulled over for a broken tail light, but they end up in jail because there’s a warrant out for their arrest due to identity theft.

Most of us lock our cars and homes. And while you’re three times more likely to have your identity stolen than your car or home broken into, most don’t think about identity protection.

The U.S. government used to say “If your identity is stolen…” Now they say “When your identity is stolen…” Then it takes an average of 607 hours (15 weeks of full-time work) to restore your good name. In 2015, 450 million records were compromised and 781 company data breaches reported. The Secret Service reports that revenue from stolen identities surpasses drug trafficking. Financial losses due to identity theft last year totaled $24.7 billion… $10 billion more than all other property crimes!

Frankly, with the likelihood of your identity being stolen, knowing you’ll be stuck cleaning it up is downright scary.

4word: What are the different types of identity theft?

Rose: Interesting question! Most people think identity theft is about finances – credit cards, credit scores, and bank accounts. That’s what the media focuses on: “Check your credit scores and free credit reports annually!” Actually, financial identity theft is less than 17% of all types identity theft! Financial identity theft is also the easiest to clean up, so we’ll focus on the other types, including:

Driver’s license identity theft. The thief replaces your photo with theirs and commits a crime.

Driver’s license identity theft. The thief replaces your photo with theirs and commits a crime.- Employment identity theft. The thief uses your SSN to get a job. The primary perpetrators aren’t undocumented immigrants – they’re people that owe back taxes and child support.

- Minor identity theft. The thief uses your child’s information to commit a wide variety of crimes. Thieves know they have years to exploit the identity before being discovered, because most parents don’t protect their kids’ identities.

- Medical identity theft. The thief takes your personal information, often SSN or medical record number, and gets a medical procedure. If you’re lucky you’ll only get a bill (or wage garnishment!). The big problem is finding find out when you’re sick that the thief changed your medical record, allergies, blood type, etc. Then this theft could literally hurt or even kill you.

- Tax identity theft. The thief files and receives your tax returns. You’re stuck with IRS scrutinizing your taxes, and waiting indefinitely for your returns.

- Criminal and Character identity theft. The thief uses your information when committing a crime. You’re stuck proving you’re innocent, and cleaning up whatever mess they made.

4word: What are some tips you can offer to prevent identity theft?

Rose: The #1 action to prevent it from happening is limiting the information we offer others. Some are obvious, like not giving information over the phone, but others we don’t think about:

Limit personal information on forms (they usually don’t need your SSN), and shred mail with identifying information like credit card offers and medical bills.

Limit personal information on forms (they usually don’t need your SSN), and shred mail with identifying information like credit card offers and medical bills.- Keep your social security card at home in a safe place, alongside a copy of the contents of your wallet. Don’t carry extra credit cards.

- Don’t write down passwords. Check out LastPass or 1Password for password management.

- Use an RFID blocking wallet or credit card sleeve to prevent your card info from being stolen electronically.

- Parents, review and approve of what your kids download. Check out OnguardOnline.gov for more tips.

- Opt out when you receive company privacy statements. Sign up for the National Do Not Call Registry at www.donotcall.gov

- Look up your Social Security Statement online (free): https://www.ssa.gov/myaccount

The government no longer mails these annually. - Parents, protect your child’s identity as if it were your own. Thieves understand they have up to 18 years to sell and resell your kids’ identities, creating problems your child will spend a lifetime fixing.

All a thief needs to guess someone’s SSN is their name, date of birth, and state of birth. Be careful what you post on social media!

4word: What drew you to become involved in the fight against identity theft?

Rose: I’ve served in various forms of social justice for years. This career resonates because so many Americans have no idea the risks they face every day. Helping others understand identity theft, and how to protect themselves, is social justice. I feel fulfilled, knowing those I help provide with identity theft prevention & legal assistance will have better lives.

Rose: I’ve served in various forms of social justice for years. This career resonates because so many Americans have no idea the risks they face every day. Helping others understand identity theft, and how to protect themselves, is social justice. I feel fulfilled, knowing those I help provide with identity theft prevention & legal assistance will have better lives.

I first learned about the opportunity to work in identity theft in an odd way. My landlord at the time wanted to move into the house I was renting, and began threatening me and trespassing. My best friend told me that Legal Shield, a legal assistance service, could help. ($16.95 / individual – $18.95 / family monthly through 4word!).

I started asking Legal Shield all kinds of legal questions regarding daily life situations, curious if I was being taken advantage of by companies. The attorneys solved my landlord situation and helped me reclaim about $1,000 owed to me. That’s when I realized I wanted to help others know their rights, too.

Through Legal Shield, I heard about Kroll, their partner specializing in identity theft, and realized working in identity theft prevention was a natural fit. Years later, I’m still thrilled to work alongside the best in the industry!

4word: What should I do if I become a victim of identity theft? How can I protect myself against identity theft in the future?

Rose: I strongly urge everyone to get some form of identity protection. Anything is better than nothing. When your identity is stolen, at least you’ll have a number to call and someone to talk you through the process.

Rose: I strongly urge everyone to get some form of identity protection. Anything is better than nothing. When your identity is stolen, at least you’ll have a number to call and someone to talk you through the process.

If you become a victim of identity theft and have no protection, you’re “guilty until proven innocent.” Depending on the type of theft, you’ll need to call all three credit bureaus, the Federal Trade Commission, Social Security Administration, Postal Service, collection agencies, Department of Motor Vehicles… The list gets longer, and varies depending on the type of theft and how bad it is. Basically, anticipate spending about 607 hours, including lots of hold time and getting the bureaucratic runaround.

We can limit the information we disclose in the future (see #3: Preventing ID Theft). But we don’t control what’s already floating around the internet and being sold on the dark web.

My suggestion: Invest in a solid identity theft prevention and restoration plan. Chances are 1 in 20 your identity will be stolen this year. Investing in a plan means saving money in the long run by not needing to take those 607 hours off work, not to mention peace of mind that you and your family are protected.

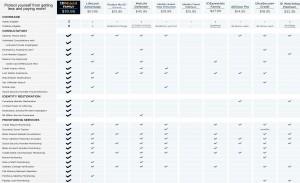

There are three primary components to look for:

- Comprehensive monitoring. You want a plan that doesn’t just monitor finances, but all your identity (see #2: types of theft), in many places.

- Complete restoration. Look for a plan that offers 100% restoration. This means when your identity is stolen, someone does all the cleanup for you.

- Equal coverage for your kids.

You have access to a great plan through 4word: ID Shield. ID Shield offers comprehensive monitoring, complete restoration, and a $5 million guarantee.

You have access to a great plan through 4word: ID Shield. ID Shield offers comprehensive monitoring, complete restoration, and a $5 million guarantee.

With your 4word discount, monthly coverage is only $8.95 / individual and $18.95 / family, with no contract. You can enroll with 4word’s discount from 4word’s Financial Resources page or at www.seeyourbenefits.com/4word

I hope the 4word community now better understands identity theft and the risks of not being protected. My desire isn’t to scare, but rather to encourage you to be aware, and to take steps to protect you and your family.

——

Did you know there were that many different kinds of identity theft? Don’t wait to become a victim before doing something! Learn more about ID Shield today!

——

Please click here to receive these impactful blogs automatically to your inbox.

——

Rose Barker is a certified identity theft and risk management specialist with Harvard Risk Management, the nation’s largest educator and broker of identity theft protection for businesses and employees.

Rose is a small business owner, inventor of the Passport Pocket, and is passionate about fostering local community. She serves on the Board of Directors for MERIT, a non-profit helping people to launch and grow micro businesses through mentorship and education.

When she’s not in Oregon, you can usually find her living in Mexico, Ecuador, or another Spanish-speaking country, usually volunteering for non-profits. You can also find Rose fundraising by bike for the Multiple Sclerosis Foundation, swimming rivers, and gardening.